Only my opinion, but customers are paying a fare whack for avoiding the small inconvenience of setting up a wallet.

The marketing sells the ETP as an advantage as “…the crypto market in its infant stages, a number of issues still exist when purchasing these assets that time and technology have yet to resolve. By offering the convenience of investing through your broker, we save investors the hassle of setting up wallets, dealing with the risks of getting hacked, transferring your funds to the wrong address, or losing your private keys.”

However that doesn’t ring very true to me and feels like they are marketing based on fear factor - that doesn’t bode well for the company ethics straight off the bat in IMO. The risk of being hacked isn’t resolved, you are simply placing your trust in 21shares, who themselves use Coinbase - a retail standard exchange. You are also paying a daily 1.49% management fee for that alleged convenience and risk reduction, plus broker fees.

There is no other apparent benefit in the ETP as far as I can tell either - unlike an ETF there is no diversification, the ETP is pure BTC no other coins, you are simply paying a lazy/fear factor tax to be blunt.

I use Coinbase myself, it took approx 5 minutes to set a wallet up, secure it with MFA, whitelisted addresses, a multi tiered approval process for withdrawals including a time delay and I don’t lose 1.49% daily for the convenience of not doing that myself.

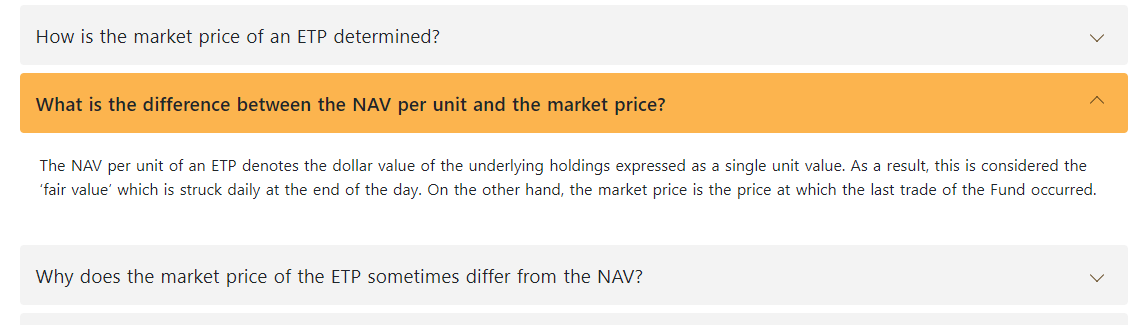

There can also be a price difference between the BTC market rate and the ETP rate - at time of writing, the ETP costs $59.33 per 0.0050 BTC but market rate was $45.27 so that’s a further cut of potential profits.

So:

Negative market difference of $14.06

Daily Management rate $1.49

Broker rate (lets use Coinbase as thats what 21Shares use) of $2.61

Costs of $18.16 if I’d bought a single unit of the ETP today.

Compared to cost of $2.61 buying direct from Coinbase. That’s a significant bite of any potential profit, assuming BTC moves enough on the day to end up in profit. Even taking out the negative market gap which presumably isn’t there every day, you are still paying an additional $1.49 daily to avoid the quite straight forward one off process of setting up a wallet - that’s not a massive overhead, but its an entirely unnecessary one and occurs regardless of the day ending in profit or loss.

Honestly, if anyone wants help setting up the wallet and securing it I’d be happier helping them for free then watch them pay a tax for avoiding a 5 minute task.