Expected to see a sp of 10p based on this, guessing the markets still lack faith. Obviously I’m no expert and only guess

Well pigs do fly, onwards and upwards!!!

Whoop whoop ![]()

Great news to awaken to on a Monday morning!

Fingers and toes

Is Lorna going to operate this drill herself?

That is probably the markets guess.

But at least they have finally taken the initiative and purchased a rig, only 18 months late!

The price will drop again when people sell off, I reckon there will be quite the sell off as well due to people losing confidence

Losing confidence? The Mother of all RNS dropped yesterday. Imo.

I was NOT expecting to reach 8p today - gained me nearly £500, gone from around 45% down to 25% down.

Lets hope the momentum continues ![]()

Appears to be doing alright, I’m up £900+atm, I can see people staying until the drill now that they have one ![]()

Slight fall back but hopefull close at 8 would be great!

It would stand a chance of holding if people didn’t sell at the first increase in price. Real steps in making the Q3 drilling target. Things are looking up.

Bought a few more

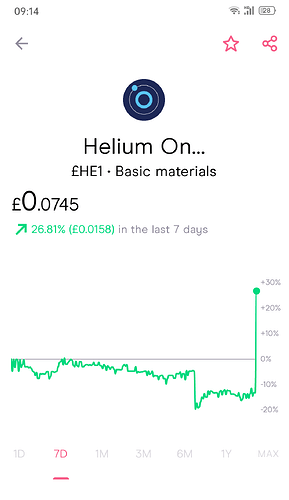

What do people make of this?

Helium One Global

HE1

Share Price 7 Day 1 Year

0.08 36.4% -4.6%

![]()

New major risk - Share price stability

The company’s share price has been highly volatile over the past 3 months.

- It is more volatile than 90% of British stocks, typically moving 12% a week.

This is considered a major risk. Share price volatility increases the risk of potential losses in the short-term as the stock tends to have larger drops in price more frequently than other stocks. It may also indicate the stock is highly sensitive to market conditions or economic conditions rather than being sensitive to its own business performance, which may also be inconsistent.

Currently, the following risks have been identified for the company:

Major Risks

- Share price has been highly volatile over the past 3 months (12% average weekly change).

- Earnings have declined by 39% per year over the past 5 years.

- Revenue is less than US$1m.

Minor Risks

- Shareholders have been diluted in the past year (31% increase in shares outstanding).

- Market cap is less than US$100m (UK£57.3m market cap, or US$74.0m).

Personally I wouldn’t say the SP has been ‘highly volatile’ the past three months, if anything I’d say its been consistent at around 6-7p, bit of a dip as we got closer to Q3 but I think that was to be expected, especially given how Q3 has been in the trimeframe for a good 6-9 months plus the lack of news/communication.

The recent rise is to be expected also, but I wouldn’t go as far as to say its highly volatile.

My original plan was to hold until right before any drill as whether they got helium in one or two drills seemed to be a risk.

Things have changed now they own their own drill outright as if they miss, even twice like last time, theoretically they can keep drilling until they hit the gas. This is now a long term hold until the company has money rolling in from selling all of that helium they’re sat on.

Major Risks

We all going to be Very Very Rich

Minor Risks

We are just going to be Rich

![]()

6p to 7p is a 16% rise, That is considered volatile