Well it’s been an eventful week so I thought I’d finally go over the recent earnings and whats in store for the rest of this year and beyond! I wanted to wait for the Global sales data to drop, many thanks to EV Sales blog!

Tesla beat estimates with 2020 sales of $31.5bn, up 28% from the prior year and $721m in net income marking its first full profitable year.

Executives were unusually quiet in their production goal, although they’ve reiterated the long term 50% growth target. Several pundits have taken that to mean 750k for this year and over 1m in 2022, so those are the unspoken objectives the stock will be judged on. Doubling in two years would be no mean feat and would put Tesla among the biggest manufacturers in the world, especially considering it is a singular brand (not to mention a sizeable energy business attached).

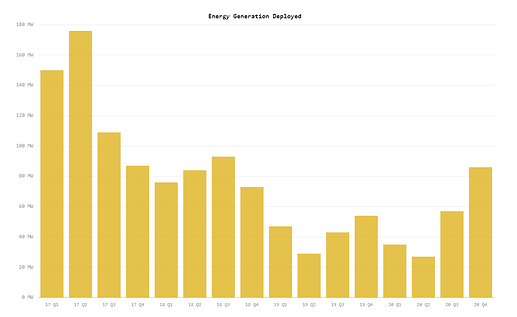

Actually the non-automotive side seems to be most promising in the immediate future. Solar deployments ramped from 57MW to 86MW in Q4, impressive considering how time consuming training and installation is. Post-restrictions this could be one of the bright spots in the entire business. Energy storage doubled to 1.5GWh and seeing such spectacular growth invigorates Tesla’s ambition of becoming a world leader in battery storage. A slight source of worry is that the gross margin turned negative this quarter, this might be a result of pandemic-induced costs for solar but is worth keeping an eye on as the segment scales.

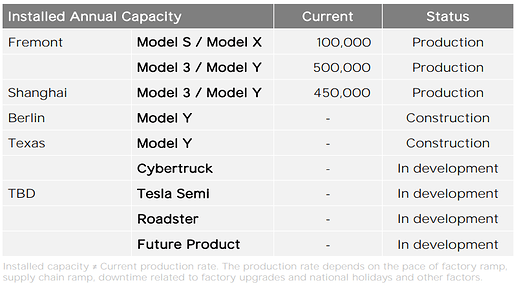

Current annual capacity is 1,050,000 which means even if Tesla doesn’t expand at all it could still hit its 2022 guidance. That is impressive. Of course, two Gigafactories in Berlin and Texas are under construction, and with more in the pipeline as well as Shanghai/Nevada expansion continuing this should not become a bottleneck, especially with a rather neat $19bn cash pile.

Regulatory credits were greater than net income but these should stabilise at €1.8bn ($2.2bn) euros annually for at least the next couple years as the newly merged Stellantis is still quite a laggard. By the middle of the decade when the agreement is set to run out Tesla’s profit should be substantially higher than this, and with a Biden administration likely providing sizeable new environmental incentives I see this as a relative non-issue.

The main downside currently is the continual delay of FSD. Many drivers agree that level 5 feels as distant as it ever has, and while bulls can rightly point to Tesla’s advantage in data collection, the reports that only 2% of Chinese buyers added autonomous features onto their purchase is disappointing. I have always seen this as the most significant risk in the business, especially now considering the majority of Tesla’s automotive profit is dictated by self driving take-up and advancement.

Global competition did markedly increase this year, among the best improvers were Volkswagen which went from 6th to 2nd place, Mercedes, which was not even in the top twenty last year, managed a respectable 6th. The VW Group now has an 11% market share and if all goes well there will be a true battle for first position going forward. I believe this may become evident in margin pressure for Tesla, especially as the board has consistently prioritised volume over profitability.

I’ve been trying to avoid it but I guess I should mention bitcoin. Elon seems to have decided to like it now and that probably means there is a not-insignificant chance of some of Tesla’s healthy balance sheet being converted. That seems horrifying to me but ardent supporters would probably see that as a buy signal given the world right now so I’m going to leave the discussion at that.

2021 EPS is currently forecast at 3.82, and sales at $47.7bn. The EPS expectations are in my view too aggressive, I think $2-2.50 is more realistic. As for revenue, expectations seem about right. My personal model gives me $47.5bn in sales assuming insurance continues rolling out across the States and the Semi is still delayed until the end of the year. A couple of upside surprises are possible; Plaid could boost S/X revenue by a few hundred million and remotely but not impossibly Tesla could launch its ride-hailing service which could significantly disrupt the market incumbents while they grapple with the pandemic and immediately be cash generative.

Shall we talk about valuation? This time last year Tesla’s market capitalisation was $120bn, rich by all means but not astronomical given the billions in free cash flow the carmaker was to produce and enterprise values in the industry. Today it is the seventh most valuable company in the world, with a forward PE of 207. It is ultimately up to individuals to decide whether that is an acceptable level to buy in (Amazon for example trades above 80 and is forecast to grow far slower), although one might say that even if full autonomy arrives and is statutory approved tomorrow there is probably only single digit upside left. The other side of the coin is that this is now a “safe trade” in a growing industry and in an era of the zero lower bound, so there is little reason not to invest for the long-term. Could I see it hit $1000/1T at some point matching the current high price targets? Easily. The stock could also get pummelled down as EPS expectations are dramatically reduced over the next few quarters. One thing’s for sure, this rollercoaster hasn’t finished quite yet.