AstraZeneca “exploring options” in the vaccine business. They got a lot of political flack from all over the place, despite it being sold at cost. But they did the right thing, and the world should be grateful.

Nothing against AstraZeneca per se, but ‘the world should be grateful’ is a bit over the top. The world should be grateful for the institutions and companies that actually developed the vaccines, e.g. Oxford University in this case. Astra only took over mass manufacturing and testing.

Taking a vaccine through multiple trials, manufacturing 1 billion+ of anything, and then managing global supply and distribution, seem like pretty big tasks.

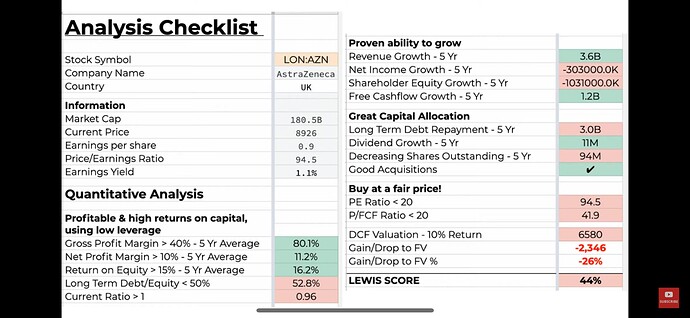

In this video I analyse AstraZeneca stock (£AZN) using fundamental analysis. Is AZN stock a buy?

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

I go through AstraZeneca’s business summary, sales breakdown & financial statements to get an understanding of the business. After this, I go through my analysis checklist and then value AZN stock using the discounted free cashflow method.

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

AstraZeneca plc is a British-Swedish multinational pharmaceutical and biotechnology company with its headquarters at the Cambridge Biomedical Campus in Cambridge, England. It has a portfolio of products for major diseases in areas including oncology, cardiovascular, gastrointestinal, infection, neuroscience, respiratory, and inflammation. It has been involved in developing the Oxford-AstraZeneca COVID-19 vaccine.

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

The company was founded in 1999 through the merger of the Swedish Astra AB and the British Zeneca Group.

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

AstraZeneca has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has secondary listings on Nasdaq OMX Stockholm, Nasdaq New York, the Bombay Stock Exchange and on the National Stock Exchange of India.

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

@LewisHarding would you share what your top holdings are and why? I’d be interested in what you’re invested in long term as it might give me some ideas or show me something that I may have overlooked.

I’d be happy to share which stocks I’m invested in and their allocations, if anyone was interested ![]() .

.

I did if we could could host a ‘rate my stocks’ thread, Do you think people.would.be up for it?

I think we should have a risk-weighted returns thread. Something like what is your return relative to your diversification, then we can see who the best investors are (or look for some trends) and see if we can learn from them.

No worries at all mate! Here are the stocks that I own so far. This doesn’t include my ETFs, crypto & crowdfunding investments. I have a watchlist of 25 stocks of which I’d like to own when they eventually get to my fair value price - based on my analysis & DCF valuation.

When it comes to individual stocks, I have a 4 ‘pillar’ process.

• Profitable & high returns on capital, using low leverage

• Proven ability to grow

• Great Capital Allocation

• Buy at a fair price

The image above is from my AZN video which shows some of the key metrics that I like to use.

I avoid sectors such as banks, insurance, utilities, telecom, real estate, car manufacturers & retail.

My favourite sectors would have to be software companies such as Adobe, Intuit & Salesforce. Monopolies such as Alphabet & Meta (Advertising online is dominated by these two). Luxury goods companies such as LVMH & Ferrari. And finally I love intellectual property whether it is a strong brand, ‘digital assets’ or patents. Nintendo, Universal Music Group & 3M come to mind!

Hopefully this helps but more than happy to chat through any of the above! I must say though, I’m always learning and things can change as I gain more knowledge! ![]()

Thanks for sharing your thought process, very useful to see how others think. You analyse in a similar way to me, but with different criteria.

I’m willing be more risky and invest in stocks that I think will grow, regardless of proven growth record. I look for fair prices as well, either using PE ratio / Price to Sales ratio for value stocks or PE factoring in growth for growth companies. I try to look at broad industries as well and assess how they will develop over time.

I avoid any industries that I don’t understand, which includes insurance, telecoms and retail. I’m invested in tech/software companies and also airlines, some banks that I think are uniquely positioned and basically any industries/companies that I come across that I think are not valued correctly for whatever reason.

Also, I never sell. Not because I think it’s the best investment method, but because I think that will allow me to learn the most from seeing the full lifecycle of an investment/company. I try to buy companies that I will want to hold for as long as possible as well. Here’s mine, for anyone interested:

It’s great to see people with similar processes! I agree that the best holding period is forever.

You have some great picks there as well!

I think the main thing for everyone is that they stick to their process, understand what they own/why they own it & remove all emotion from investing.

AZN has been on a bit of a tear recently. It’s moved back into first place as my largest holding and is at all time highs

What’s the reason?

Not really sure. There is some good news regarding drug approvals etc. but I’m not sure if that’s the reason.

Just thought it was interesting, this is one of the stocks propping my portfolio up while the US market isn’t doing so well

I’ve actually sold a portion today, I’m considering paying off my mortgage when the current deal runs out in a few months so I’m starting to build cash. However I will be keeping some AZN as it’s been a consistently good performer for me

Or if emotion is a big thing, perhaps maybe mostly or only invest in more stable asset types.

Growth stocks are great for some, yes agreed!

But to be a decent growth investor you have to have done the research and also have the conviction that this stock is going to perform. Also you shall need the emotional fortitude to hold when having a red month.

I couldn’t do it that’s why I only hold 2 growth stocks across all portfolios (7 accts total).

*Not financial advice, just my meanderings

Is AstraZeneca overpriced atm?

Half year report released today

LumiraDx deal with AZN should boost lenders BPCR stock also !