Because the money would be better spent modernising the business, strengthen the business first. Pay dividends when you are making a profit

It screws over the hedge funds and they can potentially make more money off it due to the shorted shares - Cohen owns a set amount of shares remember, and a lot of them - so he would get X amount from the dividend which can be used to go into the company

GME’s business is to make money, not try to screw over hedge funds, that’s Redditors job.

Paying out dividends would reduce the share price. What is the point of using money to pay Cohen dividends so he can put the same money back into the company?

I feel like there’s some miscommunication in the prior posts as to why dividend payouts would be a good thing. Bear in mind what follows is my thin understanding from memory, as I am at work. In essence (and assuming we are talking about squeezes):

- Paying off their debt now allows GameStop to engage into normal business practices like paying dividends, mergers, restructuring, etc.

- In the event that the company issues dividends to shareholders, parties who have loaned out their shares to short to stock must pay the cost of the dividend themselves.

- Given that retail, institutional, and insider ownership suggests that their are a significant quantity of synthetic shares in circulation, much of this dividend payout would be borne by the shorting funds instead of GameStop, else the loaned shares must be recalled or covered.

- Additionally, if GameStop opted to issue crypto dividends in the manner of Overstock (which precedent was recently set as fair), then shorting funds would be forced to buy back the shares as it’s impossible for them to issue the dividend (someone please correct me if I’m wrong, this is my interpretation based on the material). This would have a knock-on effect of making the GME Crypto extremely valuable, as they would need to be purchased by shorts to provide as dividends to others.

- It would have the effect of further evangelising their existing shareholder base.

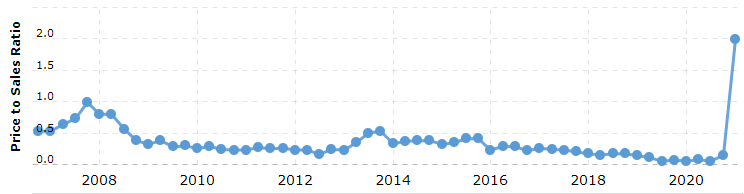

Given that GameStop has now cleared their books and is still up about ~400m, by just about any many metrics they are looking very healthy for the future as a value stock.

Interesting ![]()

It might be a good thing if you want to screw the shorts over, but GME management absolutely should not be using that as a basis for making management decisions.

Paying out dividends before the company is consistently profitable is not a great strategy

As a publicly traded company, GME’s management is beholden to it’s shareholders.

If the stock price is held down because of unreasonable (and arguably illegal) shorting - eg. using dark pools to buy while selling on the exchanges - this prevents shareholders from realising the value of the company.

However, since we are not management, we can only speculate on what their plan is. As for me, I have full confidence that the new board have a strong long term strategy, and based on my own research I personally like the direction, management and new hires enough to invest according to my convictions. Of course I might be wrong, it wouldn’t be the first time.

Everyone else is free to do what they wish with their money ![]()

Using money to strengthen the business long term is better for shareholders than paying out dividends when they aren’t profitable. If they can build a stronger business the shorts will take care of themselves

Dividends aren’t free money, it has to come from somewhere and it reduces market cap and share price which offsets the cost to the shorts of having to pay the dividends so it doesn’t actually make much difference

For what it’s worth, I’m not arguing for or against dividend payouts - I’m simply trying to elaborate on some of the theories currently being postulated. I’m happy to trust GME management to do what they think is the correct course of action for the future of the company.

This is the kind of comment that helps the GME cause ![]() That is helpful and as I said earlier the whole stealing, fraudulent and cheating are what drags the conversation through the gutter and all 3 of those exact terms have been used in this forum

That is helpful and as I said earlier the whole stealing, fraudulent and cheating are what drags the conversation through the gutter and all 3 of those exact terms have been used in this forum ![]()

Well good luck to all invested in it.

You just know someone out there would be shorting luck if they could ![]()

I think this misses the point. Firstly, the dividend stuff is pure conjecture based on the company’s decision to settle its 2023 Senior Notes. While a dividend is a possible consequence of this action, so are many other possibilities that have been restricted while the debt was in place.

Let’s imagine that a tactical dividend is the objective and the company does use a blockchain method to issue a very small dividend. If that was the case, then the catalyst for the squeeze would be in play, the share price would rise and the cost of the dividend could be more than covered by the fact that the company could raise $1bn by selling a much smaller number of shares than the 3.5 million limit.

If they pull that off, they very much deserve to succeed.

But once again, it’s not the job of GME management to gamble on trying to trigger a short squeeze.

They are talking about raising money with a stock offering, this is almost the exact opposite of paying a dividend and makes much more sense

Also, causing a short squeeze is actually illegal, and if it can be clearly shown to be the actions of the directors they can say hello to a new lifestyle in a stripey shirt rather than a pin-stripe shirt.

I think it’s worth everyone remembering that there’s no actual reason to think there’s going to be a dividend issuance any time soon, this is just pure conjecture from across the internet.

In terms of tangibles we can point at - the Lannisters would be proud of them for paying their debts. I think we can all agree this is a good sign ![]()

I agree. The spectre of the dividend is now in play though as are many other positives and it’s absolutely clear that the new team is moving very quickly. This story has a way to run.

How would crypto dividends even work. I have a fraction of a share so I would be entitled to a fraction of the dividend. I have no crypto wallet, Freetrade doesn’t support crypto (yet) how would they pay me?

Market manipulation is illegal. GameStop’s new leadership team seems to be very aware of its legal obligations. If there is a short squeeze, I doubt they’ll be in the firing line.

Crypto Dividends are a possibility, but otherwise my best guess would be security-first implementation of a GameStop e-gaming library, using blockchain for DRM, and implementing NFT for skins, etc. This is the first thing I would do if I were making a new, modern version of Steam.

Both possibilities are exciting.