hope you get it! it does feel like it’s turned a corner this last few months

So the RNS that just came out gave a positive boost to the share price, what is the view on the RNS, did not fully understand the ramifications?

40:1 share adjustment makes sense to me though in terms of the share price, will that help it become less volatile?

Mind the first time I invested in this company I bought at £0.03 per share, so a bit of a way to go to get back to that…. Guessing people on here invested for a lot more before me though, feeling glad I stuck at it atm..

I’m finding it hard to get my head around but the market seems to like it. Let’s see where it goes over the coming weeks .. corner is being turned i feel

wow ![]()

A share adjustment and also money raising round should worry me but as I’ve been in the red for so long on this stock at least it’s activity. And, at the moment, positive activity.

On the whole I’ll hold and see what happens.

could also be a sign of confidence that other investors are prepared to finance the company, in addition to Powertree punting £5m on them. Plus, immediate financing concerns are completely removed. Interesting times for sure

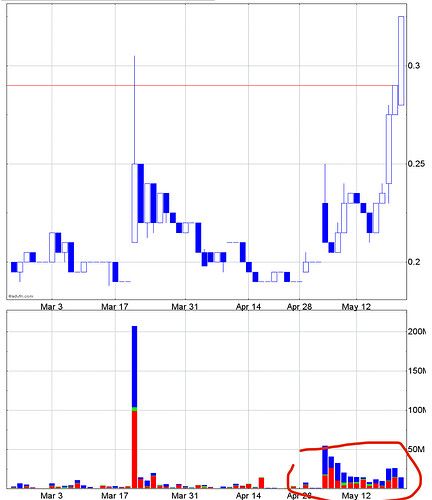

Still a lot of buying going on up here. Very interesting. Fingers crossed this is the start of something

It’s MAST’s time to shine.

Floated at £23m. Untold problems, now light at the end of the tunnel.

Steady monthly revenue from Pyebridge model.

Off the back of this proven model secured £5m investment from Powertree to develop the Hindlip project. No capital required from MAST.

New cash funding and big backers.

Further revenue generating projects in planning.

“MED and Powertree will further grow the partnership with a next site in the near term, and potentially more thereafter”

You can now begin to see how the target of 300MW per month might be achieved. At £24,200 per month per MW, the story just started.

It could be tightening up around here imo. This story isn’t over by a long shot.

Mast Energy Developments (LON:MAST) is charging ahead — and the market is finally starting to notice.

With the Pyebridge plant now online and generating consistent monthly revenue, MED has crossed a major milestone in becoming a real, cash-generating power player. Current figures show the plant is delivering £22,400 per MW per month — a strong foundation for scalable, recurring income which begins to add up considerably when you consider the 300MW per month target.

But the real spark? Firepower.

MAST has just completed a £4.65 million equity fundraise, alongside a £5 million strategic investment from Powertree Holdings, giving the company serious financial muscle to deliver on its ambitious rollout plans. These fresh injections of capital now position MED to aggressively advance its 300MW flexible power generation portfolio — a national-scale infrastructure play built for the energy reality of tomorrow.

The company’s 7.5MW Hindlip project is already construction-ready and now fully funded, with building expected to begin imminently. This site marks the start of a long-term growth partnership with Powertree and sets the tone for what’s to come: a UK-wide network of flexible, fast-response power plants that can stabilise the grid during times of renewable shortfall.

With energy volatility increasing, flexible generation isn’t just valuable — it’s vital. As solar and wind adoption grows, so does the need for immediate, on-demand backup when weather conditions don’t cooperate. Europe has already seen the consequences — with recent blackouts highlighting the urgent need for reliable support infrastructure.

Governments, regulators, and energy providers are now turning to solutions like MAST’s — quick-to-deploy gas-powered plants that can fill the gaps and protect grid stability. This isn’t a niche opportunity. It’s an emerging backbone of the green transition.

And yet, LON: MAST still trades with a market cap of just £3 million — a figure that massively undervalues the scale of its assets, revenue potential, and future footprint. With fresh capital, fully funded projects, and a clear national need.

Mast Energy Developments is no longer just a vision — it’s becoming a powerhouse in the making. Early investors here are set to see significant growth.

Was wishing I had sold like week at 60% up but still decent buys an volume about

Could get going again yet. If you listened to Ceo interview he’s still got new assets to bring in once the funding is secured after a general meeting

going again ![]()

Is it possible that at some point Battery storage will make their model unnecessary do you think?

Not in the very near future obviously.

Size of that buy this am bodes well hopefully.

anything is possible. but in the immediate term they’ve got 5m funding, 5m from powertree, and ceo talking about new assets incoming. I mean there’s no rule that says you have to hold forever is there?