Will Freetrade be getting a slice of this pie? ![]()

Hello all it’s certainly an interesting proposal. I think we can all agree the Uk economy needs serious growth.

On the other hand I don’t know how I feel about my pension being risked in such a way.

Either way I hope it works

There’s going to be a few thousand new vegan ‘meat’ and artisanal gin startups because of this.

Were you aware that they are milking you for $3 Trillion @CashCow

Had I known I’d have given you a squeeze myself!

Which will all go into liquidation within a few years and the 75bn disappeared ![]()

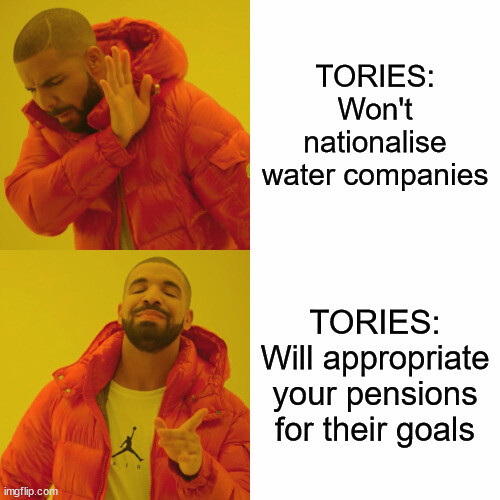

Coincidentally run by Conservative party donors no doubt .

There’s no need to be so cynical! I am sure this will…

“British pensioners should benefit from British business success,” Hunt said

LOL I think I’ll keep my personal savings geared towards the EU and USA and out of Brexit Britain.

I’ve seen what this guy did to the NHS and what his chums did with with covid cash, from PPE to Test and Trace apps, and what they’ve done to the economy. the country’s global standing and reputation, infrastructure, national debt, etc etc. I really don’t think they’ve got regular saver’s best interests at heart.

Hunt estimated in his speech that the reforms could increase the retirement income of an average earner by over £1,000 a year.

Oh shit… those average earners are going to end up losing several thousand a year.

…indeed. Talk about about flogging a dead horse.

If we don’t get back in the EU to solve the same problems that were solved by us joining in the first place, we are a more stupid country than we appear even now.

I wouldn’t mind my pension being invested in British companies if we were to re-join and have some hope of growth - but looking at the current outlook (and still blaming ‘boat people’ and other foreigners for our problems) I think your idea of keeping investments out of the UK is a wise choice.

It’s easy to miss the fact that inflation can be caused by a lack of workers. Competition for workers drives up wages and demand for drivers has been huge, driving up prices for goods to pay the increased wages.

From my perspective, it is not a lack of investment from our pension funds causing the problem - but a lack of workers!

You may be right OrbitalInvester but unfortunately our chances of rejoining the EU are slim to none. When we left we burnt the bridges and showed ourselves to be untrustworthy.

We have to make the most of what we have in front of us and I say this as a “remoaner”.

Further to @CashCow can someone explain to me why we aren’t renationalising Thames Water? Are they going bust or not?

It reminded me of Keir Starmers policy of using our Pensions to fund much needed infrastructure. It was panned at the time but at least we could see where our money was going.

The next General Election will be very interesting.

Has this been been confirmed and approved or just something that they are planning? I was expecting something like a concrete data for the change.

To be honest, I want my pension to stay out it. Start-up investing is not where I want to gamble my money. I have no idea where their calculations come from, but their are making some bald claims.

You can find some details in the Chancellor’s Mansion House speech linked below.

It sounds like agreement has been reached with some of the biggest pension providers to up private equity allocations to nearer 5% by 2030. This is for their default funds though and other options exist.

On the other hand, doubling local gov’t pension scheme allocations to private equity seems to be more at the planning/consultation stage.

I’m unsure if I agree with the policy but I’m hoping it will be a tailwind for my unlisted holdings.

With many providers, e.g. Aviva, you can choose what you invest in. So, there’s likely no need to move to a SIPP because of this.

This topic was automatically closed 416 days after the last reply. New replies are no longer allowed.