The bullish view on commodities is gaining widespread traction so I decided to look into some of the reasons behind the hype, the information below is a summary of what I believe to be the main drivers.

-

Commodity supercycles are multi-decade periods of price rises and falls. There have been six commodity peaks in the past 227 years. The most recent peak was in 2008. If the supercycle trend is to be believed then it is pointing to a turn in commodities through the 2020’s.

-

Even if the trend is to be believed it still needs to be supported by fundamentals - that’s where a weakening USD, increased economic activity, and inflation come into play. All of these support a bullish view on commodities.

-

USD has seen 3 major downward cycles since the advent of floating exchange rates: 1977-1978, 1985-1987, and 2002-2008. Each downward cycle was driven by concerns over outsized US current account deficits with low nominal and/or real short-term US interest rates. Similar to now.

-

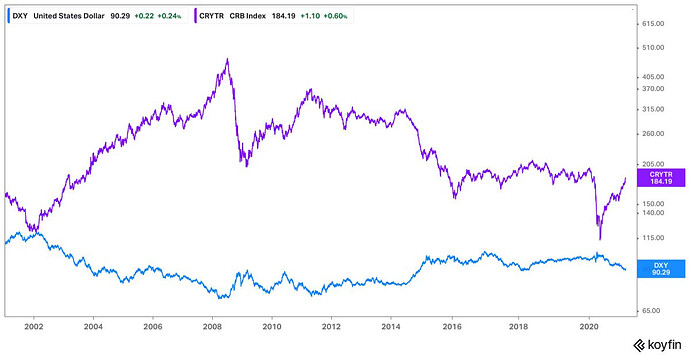

It’s not perfect, but there’s a significant inverse relationship over time between commodity prices and the USD. USD is the dominant exchange mechanism used in the international trade of commodities. When the value of the USD drops, it costs more dollars to buy commodities.

-

As a result of the 2008 financial crisis many markets today have a combination of low interest rates, low inflation, weak demand and a preference for saving over investing. These factors have resulted in a global liquidity trap - the US is one example.

-

Some ways to get out of a liquidity trap include raising interest rates (not likely), hoping the situation will regulate itself as prices fall to attractive levels, or increased government spending (this is the most widely supported).

-

When it comes to government spending the negative impact of borrowing depends only on the size of the package but the positive impact depends heavily on the composition. To get the biggest “bang for the buck” governments needs to focus on high-multiplier spending.

bit.ly/fiscalm

-

Infrastructure spend will offer the best value in most cases. When job security falls, households tend to increase their precautionary cash balances and pay down debt, negating the affect of transfer payments (unless they are low-mid income households).

Most Stimulus Payments Were Saved or Applied to Debt | NBER

-

The next phase of economic recovery (not just in the US, but globally) is thus likely to be driven by commodity-intensive infrastructure investment as governments use a green industrial revolution to kickstart growth (this can already be seen in Europe and China).

What we learned from the Chinese and European infrastructure initiatives - Fastmarkets

-

As more countries join the green industrial revolution there will be a surge in demand for metals, this can already be seen in the price of copper which has risen above pre-pandemic levels.

Coronavirus: How has COVID-19 affected global commodities? | World Economic Forum

-

Inflation has become increasingly less variable since the 1970s so its contribution to commodity price dynamics has shrunken accordingly. However shocks to inflation (as seen in the mid 1970s) are still expected to have a large affect on commodity prices.

econstor.eu/bitstream/10419/45904/1/661649679.pdf