What happens if you own 3 shares. That’s how many I hold.

I believe you will then end up with 2 shares, and £1 something for the third share. Then hopefully increased share price before too long and increased dividend…I think ![]()

So if you have 1 share you just get cash back and are no longer a shareholder?

That’s right, yes. You get the cash equivalent of that 1 share.

Is it worth a buy now? If I did, I think I would qualify for this as you are eligible until 13th May 18:00. Is that correct?

Hi you would be able to receit the b share payment etc yes. As for if it’s a buy that’s up to you :-). I personally like Aviva, and in therory once there are less shares the share price may recover quickly and go up, in therory the dividend yield will also benefit.

I personally am going to wait and see if they they dip once the b share is issued to grow my holding as my average is £3.88 and would like to try and keep it there ![]()

Less shares doesn’t mean a company is worth any more, if you slice a cake in half or in quarters you still have the same amount of cake. In fact with stock splits we’ve seen the stock out perform the market.

A dividend yield is something an investor monitors but a company doesn’t, Aviva think in pence and dividend growth (year over year).

The yield is the dividend / price you paid, unless you buy or sell it’s the same regardless of the share price. I have shares that are yielding me +9% but the app is showing %7 because the price has gone up since I brought them.

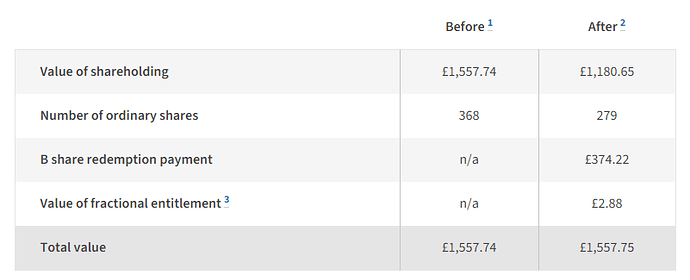

If you pop to the site and scroll down you can enter the share number you hold and it will tell you how much you’ll hold post implementation and the cash you’ll get too…

I’ce screen grabbed an example

So after the cash return and share consolidation you will be in the same position you were before except if you want to use the cash to bring your holding up to the same of shares you had before you will have to pay stamp duty on the buy. Seems a bit pointless to me tbh.

Yes. From what I understand many us companies do it. Because some us companies are a bit more on the expensive end, it makes them look more affordable.

There is a much stronger investing culture in the US with less access to fractional shares.

The Dow Jones based on share price so you’re incentive is not to split the stock - this is often why traditional companies don’t while NASDAQ tech companies do.

Will this cease trading from tomorrow. Tomorrow is the Ex date for the special dividend and consolidation

Just posted these in case you hadn’t seen them

I see the consolidation has gone through so we have less shares I assume the ‘b’ shares worth a pound will appear shortly.

I think the payment for the b shares comes in to accounts on 19th. Iv just topped up the amount of shares that I will be losing. Hoping not too premature for best price.

Same here on the top up I’m not sure where freetrade get the average price paid per share so far of £5.3162 should be £3.93 odd I should think

Yeah my average jumped up lots too. Iv given up trying to work it out ha. But I’m sure by end of the week it will all.be clear. Iv got rough idea where my average is sitting. Just thought may be good idea to buy now before the dividend pays outs and the b share penny’s come through

Will they update the avg share price?