Again, a classic innovator’s dilemma.

TD still has an $18 billion market cap. Scwab—$48 billion. E*Trade—just under $9 billion.

What’s weird is that E * Trade has an office in downtown San Francisco. So does Fidelity, which also does a fair bit of venture cap investing. A 10-minute ride on a streetcar from E*Trade will take you to Twitter, Uber, Square. A 30-40-minute ride on a train will take you to Palo Alto.

If you were an investor in those companies, you should’ve raised these issues years ago.

Or better—invest in :freetrade: and become part of the next thing.

The good news is that these companies may have to cross sell other products and sneak other fees into the bills to make up for lost revenues—public companies get punished if they are not growing. Meanwhile, :freetrade: can focus on own business model.

RH was launched in 2013, so the old guard on the other side of the pond had a 6-year warning and a signal that that was Vanguard lowering its fees.

Even JPM launched its own platform called You Invest.

It’s hard to cannibalise your business iPod-iPhone style or the way MS Office/Adobe switched to recurring subscriptions for Office/Photoshop.

And the millennials and gen Z probably haven’t heard of TD, E * Trade or Charles Schwab. So these companies are left with advertising to industry people? You have to have a cool brand to appeal to Gen Z. Otherwise, Apple would have put a Goldman Sachs logo on its Apple card (because you’d effectively be banking with Goldman if you get that plastic.)

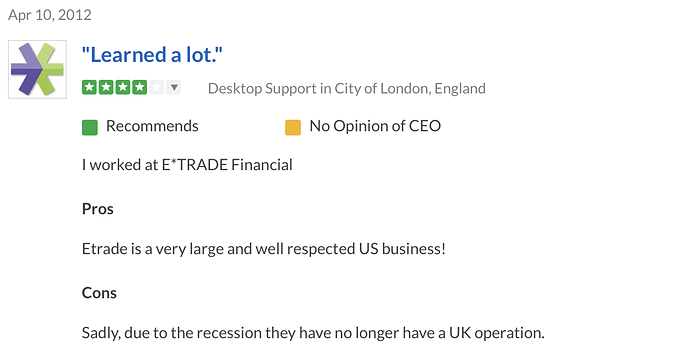

Source - https://www.glassdoor.co.uk/Reviews/E-TRADE-Financial-Reviews-E6005.htm?countryRedirect=true

Meanwhile, RH has just opened an office in Denver, which is full of software engs.

Major brokerage firms have been pressured to go to zero fees since 2013 when Silicon Valley start-up Robinhood offered stock trading for free. Since then, Vanguard Group slashed fees on ETF trades and J.P. Morgan Chase started its own free trading app.

…

TD Ameritrade’s chief financial officer, said its zero fee structure will have a 15% to 16% impact on quarterly net revenues, compared to the 3% or 4% that Schwab’s CFO estimates.

Bank of America estimates TD Ameritrade generates 28% of revenues from commissions and Schwab generates only 8% from revenue. E*Trade, which still charges commission fees, gets about 17% of revenue from commission.

…

Barclays downgraded the entire online brokerage sector on Wednesday, including Schwab, E-Trade, and TD Ameritrade, to underweight for getting ride of its “most lucrative trading product.” The firm said E-Trade will have to follow. Shares of E-Trade fell 5% in premarket trading on Wednesday following a 16% decline on Tuesday.

Source - The end of commissions for trading is near as TD Ameritrade cuts to zero, matching Schwab