So he will pay $20 x 120,000 x 100

Where is he getting $240m from ![]()

And if GME closes 1c below $20 on the 21st he looses everything ![]()

This is why I’m a bit dubious about it all

It’s like poker

Why would you show your hand

The other big players will eff you up ![]()

He can exercise long before expiry and use some cash ($30mil+) and employ an Exercise-and-Sell-to-Cover strategy.

He may have done this already today.

Ridiculous!

I think anyone who is in GME needs to consider what he is going to do at expiry. is he going to exercise and sell? what will happen to the price if he dumps that many shares on the market? Does he have the couple of hundred million to buy and hold the shares and would he do that even if he could? will there be trading halts if this causes the price to move wildly (in either direction)?

You need to consider your exit strategy. Waiting to see what Roaring Kitty does might leave you holding the bag.

Not trying to give advice about what anyone should do, Just suggesting that you consider all possible outcomes and try not to end up on the wrong side of the trade

Great advice here, have a plan and stick to it. RK has shown in the past the he is likely to exercise a day or 2 before expiry, I have no reason to believe he would change his approach now. Whether he has backers or has traded his way up over the last couple of years I don’t know but I do have confidence in RK not rug pulling us. I don’t think he’d bother with a return to Reddit otherwise.

whats an exit strategy?

Are they not call option he holds, so he has the right, not the obligation to exercise the call (he is going to be the buyer NOT the seller). The issue i see is finding the amount of shares that are going to have to be sold to him at that price if he does exercise.

I would assume he has enough cash on hand to cover.

It is going to be interesting how the album nft will affect the price. Will also be interesting to see how many shares actually get validated to it.

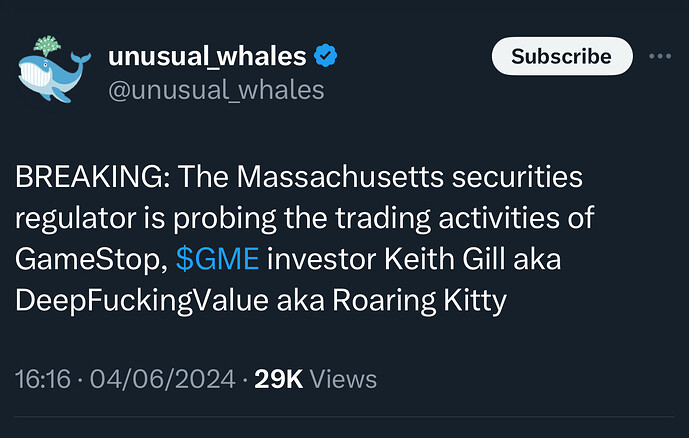

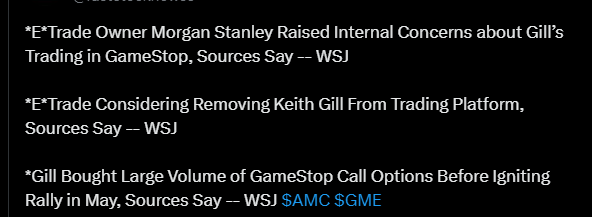

I don’t know if he has $240 million but he has options (pun intended) either way. That issue is on the market maker who sold him the contracts, along with E-Trade. Some rumours swirling that they want to remove him from the platform but I give no credence to those as I can’t see E-Trade doxing a customer who has posted anonymously elsewhere.

True he doesn’t have the obligation to buy, so you also need to consider the possibility the options expire and he doesn’t exercise them. This is only likely to happen if the price is below the strike price. in which case he will lose his premium

My point about him selling is that if he does buy, unless he has the $200M + to actually pay for the shares he will need to sell at least some of them immediately

But it’s an option contract. There is someone on the other end that has the stock to sell.

You would think…

That implies the sellers are fully-hedged…

Narrator:

They sale was naked.

Wait and seeeeeeee