I think we’re in for a wild ride today and Monday ![]()

investors quietly waiting in the shadows enjoying the show ![]()

The one thing I can’t work out is that if the HFs are NOT covering the shorts as people say then who is buying to make the price go up then down again and again? This must mean people are buying high and losing out whilst some are buying low and gaining.

Of course they could all win in the end when the covering gets done but at this moment in time there must be a shed load who bought high and are losing. This is what worries me that you hardly ever hear people say they are down and only how well they bought.

Maybe I am wrong but to me it implies a lot of people are not doing too well at the moment, and I said it could work out well in the end, but are silent. This is the problem with hype, you only hear the positives as the reality gets drowned out often.

Of course, it could/should still be great for most but I do get concerned at the lack of the flip side to the whole meme narrative.

Check this site out. You’ll see if you scroll down that half the trade volume is shorting, half is also being executed on the Dark Pool as opposed to the open market. The theory being hedgies are using the Dark Pools to buy and Open Market to sell driving the price down. ETF and others will account for some buys and as we see with the AMC thread people are still willing to buy stock at hugely inflated prices

Also the trade volume on GME has been minuscule compared to AMC so there isn’t that much to account for in comparison

Interesting ![]() Not saying it isn’t accurate but I wouldn’t trust a site that is a STONK PR tool. You may may well/probably are right but I still think there must be many who bought badly as it can’t be the HFs only screwing themselves over again.

Not saying it isn’t accurate but I wouldn’t trust a site that is a STONK PR tool. You may may well/probably are right but I still think there must be many who bought badly as it can’t be the HFs only screwing themselves over again.

I know it isn’t a popular opinion but I do worry that they are a lot cleverer than people give credit to and they will some how weasel out of it, hurt but not fatal.

My last 25% of GME/AMC, cashed in 25% which paid off investment and also made 50% profit, and 50% of BB is all pure profit now so happy to stick to whatever and if I miss the peak and it falls I won’t be bothered either.

Good luck to those invested ![]()

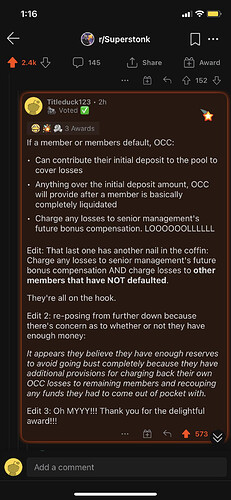

Nothing wrong with a healthy dose of scepticism imo. I personally don’t think they’re that smart at all. There’s just never been any real punishment for them when they’re caught. OCC-2021-003 now implemented should change that going forward though. They can now use EDCP (Executive Deferred Compensation Plan) to help cover any defaults that may arise. From my understanding these are basically the Execs future bonuses ![]()

Well I agree on that ![]() Personally I hate HFs and shorting should be illegal in my opinion. I know some say it has uses but I just hate people making money hoping a company goes down and it is disgusting.

Personally I hate HFs and shorting should be illegal in my opinion. I know some say it has uses but I just hate people making money hoping a company goes down and it is disgusting.

About the compensation people mention, is there a limit? or do authorities give X amount a share? I know it is unchartered waters but it is intriguing although I avoid info from either extreme view ![]()

It’s much better than watching Eastenders or some random crap on tv though ![]()

Couldn’t agree more.

The DTCC insurance? Think that’s around the $80 trillion mark so no worries in terms of it running out. They wouldn’t be allowed to give x amount per share as that would be them essentially valuing the company. Funnily enough, this is what Jim ‘the douchbag’ Cramer advised back in Jan/Feb, ‘give them all $240’ or some such lol.

Way more entertaining and less ‘mind numbing’ ![]()

I’m not sure what you’re arguing here.

If the company is still trading normally, and people have shares, they get to dictate the price they sell at (or nobody sells because the buyers don’t want to pay the prices being asked). The buyer (in the insurance case, I guess the DTCC) can’t just say “we’re going to force you to sell your share for X” without really breaking confidence in the system.

At most, I think they can offer to buy shares for a certain price and just wait for enough people to take up the offer such that all the excess shares are taken off the market. At that point all the shares will be accounted for and presumably the price will then fall to the FMV, so people might well be better off taking the offered price. But, I think trying to just take people’s shares and giving them compensation instead is tantamount to fraud at a regulatory level.

It’s complicated and god knows the answer but there isn’t a hope in hell $80 trillion will be used ![]() Congress argue over 1 for months. The problem is that if the amount was obscene it will trickle down to the man on the street as there isn’t some trillions hidden under the carpet.

Congress argue over 1 for months. The problem is that if the amount was obscene it will trickle down to the man on the street as there isn’t some trillions hidden under the carpet.

I don’t pretend to know the answer other than the governments won’t let the whole economy collapse over a meme stock and laws can be changed in emergency etc which this would be. In reality though it will be somewhere in the middle.

Would they not pay out whatever the market level was at the bankrupt time? Like a robbery or something? Insurance pays out at market value normally and this scenario is essentially a robbery by the HFs.

Well, the correct process should be that the HF go bust, the brokers try to get the fund from the bankruptcy proceedings and then maybe go bust in the process when they still don’t have shares and people start suing them for fraud.

Somewhere along the line, someone will offer to buy shares for $50, $100, whatever and it’ll seem like a better offer than potentially zero, and some people will take it.

I wasn’t arguing anything, I was answering a question from Gary. You’ve said exactly what I’ve said unless I’m missing something?

Sorry, I didn’t mean arguing in that sense. I meant I didn’t understand what the argument was that you were putting forward. But if we’re in agreement, I guess I understand it now! ![]()

TDAmeritrade has now also suspended short selling of GME. One by one they’re all trying to limit their exposure

Not sure if this has been posted but it looks like Melvin has now permanently closed its doors.

No I can only find old story

Hedge fund Melvin Capital has closed GameStop position -spokesman (yahoo.com)