Anyone in this? Has performed/recovered well recently but has taken a (hopefully) short-term hit from the recent reports on Amigo Holdings elsewhere in the industry.

It trades near 52 week low, and the dividend yield is high. Source: HL

I’m not in on it, but considering now.

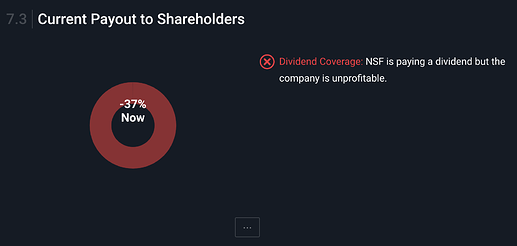

(Full-year) dividend is expected to be 3.0p this year - over 10% at current prices.

How well covered by earnings is that dividend? It seems unsustainably high.

is this a bargain now ?

Haha… any day now!?

Bump

Post from Jan 20 reminds me lockdown wasnt always here ![]()

Is anyone buying in whilst this is really low?

If they can survive the pandemic and a year or so out the other side, they may end up flourishing. The problem is that the company relies on those likely to be impacted most by the pandemic (self-employed to an extent, those with poor credit and those in receipt of benefits) so their main source of income could be in a trough and put the business in danger.

As the economy recovers and livelihoods return to normal, they may have an expanded customer base due to pandemic impacts as well.

DYOR of course, but may be worth a bit of a gamble if it sits within your risk appetite!

Thanks for the reply Scott ![]() . I’m up for the odd risk here and there. Been trading crypto for about 4 years, had a few wins, had a few losses, even had a life changing missed opportunity which is a shame, but thats life. Had a good look into the company as didn’t even realise they had so my branches across the UK, so I reckon I will dip in a little and leave it sat there.

. I’m up for the odd risk here and there. Been trading crypto for about 4 years, had a few wins, had a few losses, even had a life changing missed opportunity which is a shame, but thats life. Had a good look into the company as didn’t even realise they had so my branches across the UK, so I reckon I will dip in a little and leave it sat there.

Hoping for continued growth with occasional dips as we approach closing gates of pandemic.

If they have the ability to return to anywhere near pre-pandemic prices then there’s some tasty returns to be had

If they don’t get hit too hard following the FCA outcome in Q2 and they can raise capital from Alchemy. The inevitable return to doorstop lending (potentially exacerbated by the need to cover costs post COVID, as grim as it is) could well see a good return maybe not this year but following on the heels of the country opening back up.

Is this looking like a good medium-long term hold?

Guess that depends when you buy.

I got in march last year so its ben a good mid hold for me. I see little reason to sell with my green % but then my avg is pretty tasty

Got quite a big % in this. I’ll be holding for the foreseeable future.

It’ll get better more so pass April.

That’s what I reckon, and is only my opinion. DYOR as my reckoning is judged by vaccine rollout.

What’s the feeling on this one at the moment?

I’ve been holding since November, based on the pre-Covid price. I’m up, but this and Amigo are my most speculative “investments” and are pretty much gambling as far as I’m concerned. They could rebound to 30+ pence, but it’s not as simple as the price before the pandemic. I think I’ll be holding until the economy rebounds and a lot of lower paid workers have burned through their lockdown savings/are desperate to borrow. Plenty could happen before then.

One might hope this sudden jump is a positive sign of FCA decisions etc.

Unexpected downturn here! - opportunity to buy ![]()