Weswap are currently crowdfunding on seedrs, and I know we all love a good fintech. Anyway, due diligence is long and bothersome - calls, emails, news articles, company filings, etc… ![]() So here’s mine to hopefully save you some time. I can’t disclose non public information about the company (e.g. From the pitch deck) else weswap might weslap me. I welcome criticism and feedback - I will edit this post as the campaign develops. If you cba to read this (

So here’s mine to hopefully save you some time. I can’t disclose non public information about the company (e.g. From the pitch deck) else weswap might weslap me. I welcome criticism and feedback - I will edit this post as the campaign develops. If you cba to read this (![]() ) , you can always read the tl;dr at the bottom. I’ve tried to offer an unbias, balanced viewpoint.

) , you can always read the tl;dr at the bottom. I’ve tried to offer an unbias, balanced viewpoint.

Beyond being a potential investor, I have no affiliation with the company.

Introduction

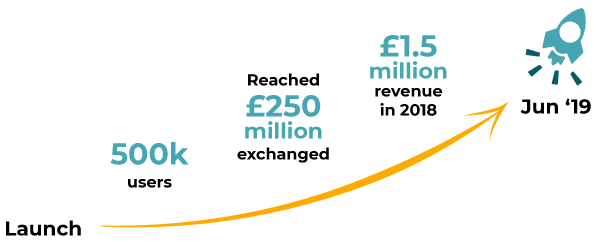

Weswap is a travel fintech startup that pioneered cheaper consumer exchange rates through peer-to-peer currency exchange. Their service is packaged in an award-winning mobile app and a pre-paid (master)card. The company is live in 10 countries with ~16 currencies, and has now exchanged in excess of £250m worldwide. They are hoping to succeed in the increasingly competitive remittance sector by dominating the holiday money niche. ![]()

![]()

![]()

![]()

Company:

Team

CEO and founder Jared Jesner is a physics graduate from UCL. He hasn’t scaled a business before, however, he has experience as a currency derivative trader at JP Morgan and a large German investment bank. He also has tech/payments experience with Royal Dutch Shell. He has a meaningful stake in Weswap (demonstrating his confidence in the business), according to Companies House (CH) filings.

Co-founder Simon Cardoti resigned back in 2015, though he still holds a notable amount of (voting) shares in the business.He has made immediate resignations in ventures prior and since. I have yet to determine the reason for his departure. Hmmm.

Product

You get a pre-paid card that is connected to the app. A user can then swap, say, 500GBP into EUR with another Weswap user for a fee. Weswap tidy up the leftovers at no extra cost.

With the app you can swap currencies, load, spend and transfer money.There are flairs of challenger bank inspiration: blocking cards in-app and bill splitting. The standout features for me include next day cash delivery and smart swap (users pre-select an exchange rate, and their currency swap is executed if and when that exchange rate occurs in the market). Lending and insurance products are on the roadmap, as well as API integrations from the travel sector (e.g. Airport parking apps).The app has won best travel money provider in the 2019 british bank awards. It is rated 9/10 on trustpilot, across 3.4k reviews.

The app/card has some notable limitations, namely: only 10 transactions a day, and a weekly £2-400 withdrawal limit.

User growth

Having grown to ~500k users (active users are all that matter - they make a relatively small portion of total users, though growth is still strong) from zilch in ~3.5 years, growth has been strong and largely organic . Customer acquisition costs are relatively low in relation to the lifetime value of a customer for now. Next year, Weswap hope to pursue European expansion, already having a notable number of EU users without marketing. The Asian market is on the cards thereafter.

Financials

Business model

The business model is straightforward: Weswap charge 1-2% on exchanges, depending on how quickly the customer needs the swap executed (the sooner, the more expensive). They charge additional fees such as card replacement fees and ATM withdrawals. They continue to search for additional revenue streams. Having proven their revenue model, Weswap now need to prove their net renewal model; they need to demonstrate customers come back/buy again. They give some impressive figures, but I remain concerned that no precise indication of churn (how many users they lose) is given in the pitch deck. I am waiting to hear back on this. Sometimes its what they don’t tell you that’s important.

Revenue

Revenue has shown grown very well YOY, to reach £1.5m. Gross profit growth is also strong. This is a key reason in support of the case for investing. Pitch forecasts are often optimistic (but then what kind of founder would go ’ Growth probably is going to be so-so I reckon’?) in my view, to the point of taking the mick, so I take these with a serious pinch of salt (I ignore them).

Need for capital

Runway is the length of time a company can survive with its current cash balance. Running out of cash is the secondmost common reason for a startup to fail, according to CB Insights. I am still awaiting a response on their runway as CH filings are dated, but companies tend to be too optimistic about their burn rate/cash spend anyway. Given current revenues, debt and future business plans, i’d ballpark their runway at under 1 year, assuming they raise £3m this round. This isn’t enough cash to get to breakeven /net profit ofcourse, but hopefully plenty of time to deliver significant value before raising further capital/exiting.

Debt is a b*tch for investors because it can convert to equity upon certain triggering events, (thereby diluting shareholders) or suck up capital that should be used for growth (crippling growth/ROI). CH filings/charges reveal that there is a combined £2.5m in venture debt intstruments outstanding from IW capital and ascot capital. Weswap have generously disclosed debt that is not yet filed/due on CH, to the tune of an 850k loan due in October. So there is quite a bit of debt to pay off in the near-medium term.

Competition

Competition:

The strength of competition is extremely off-putting for Weswap as an investment. Nevermind the incumbents (retail Fx brokers, banks, post office, etc) - there are plenty of innovative, well-funded companies in the remittance sector. It’s key to understand that Weswap are focussing on the traveller/holiday market (a multibillion pound market in the UK alone) , whereas their rivals have a much broader view. A taster:

Currencyfair are an alternative p2p currency exchange platform backed by the VC heavyweight Balderton Capital. Interestingly, they pretty much undercut weswap, charging a fixed £3 fee and an additional 0.1-0.6%. They are focusing on asian markets at present. Quite a generalist platform, useful for expats, etc.

Challenger banks are tough competition. The fintech darling monzo offers the mastercard exchange (interbank?) rate, with no additional fees. Monzo is increasingly well funded, but currently focussed on US expansion.

There is honestly a mountain of remittance startups, so let’s leave it with this taster. For those interested, Transferwise, Worldremit, Azimo,Transfergo, Paysend, and even Paypal are competing in the space. A far from exhaustive list, though.

Investment:

Valuation

Valuation: Super important. Valuation effectively dictates what your return could be. Ultimately, businesses are valued as a discount of their future cash flows. As startups rarely have (free) cash flow, they make for very speculative investments, and an alternative, more subjective pricing approach takes over. It’s trending to value startups as a multiple of their revenue. Weswap is going for an, I have to say, eye watering ~25-30x revenue multiple. Transfergo, a similar stage remittance startup, was going for 10x revenue on seedrs last year.

Exit

Exit: Startups of this nature usually exit via IPO or a merger and acquisition (m&a). The business has explicitly stated an intent to IPO quite soon - for some investors, a short holding period is a plus. Be mindful that Weswap abandoned an IPO attempt earlier this year, citing poor stock market conditions. Some may take this as a sign that their valuation was challenged when placed on a more efficient market (London Stock Exchange; AIM). Thankfully, fintech m&a activity has been strong in recent years (Vantiv’s acquisition of Worldpay in 2018 is a great example), so m&a is a probable exit strategy.

Terms

Terms: All shares issued by weswap have been either A shares or Z shares, according to the confirmation statement @ companies house. The Z shares are equivalent to the A shares, save for voting rights, and some VC-owned A shares have a preferential right to capital. The campaign offers A shares. Things to bear in mind about companies house is that the filings are on occasion incorrect (!) and typically only accurate as of atleast 9 months ago.

Shares will be held under seedrs nominee structure, which investors will be beneficial owners of. Whilst seedrs are incentivised to act in your favour (their ‘carry’ fee means they make money when you do), there is always an element of moral hazard or counterparty risk in having someone else own your shares for you.

The business does not appear to offer EIS eligibility.

TL:DR Weswap is a card/app that offers holiday goers currency exchange fees up to x8 cheaper than traditional means. People love the app, and they have grown to 100k active users and £1.5m annual revenue in less than 4 years. Travel company partnerships are hoped to drive growth further in the coming years. The valuation is up there, they have quite a bit of debt, and they have stiff competition from other startups/scaleups that are equally as innovative. Their success ultimately hinges on their ability to dominate the travel money sector, a potentially neglected pocket in the remittance space.

This is not investment/tax/financial advice. Please consider the risks before investing. All opinions are my own.