I sold out after the news for 126% profit. Something I thought I would not do but the fundamentals are not strong enough to pass the opportunity to take profit at this time.

These funds are now reserved to put back in should it reach $20ish again.

I do not. If this is a fun gamble for you then fill your boots and I wish you well. If however you’re telling yourself “it’s a long term hold for me” then I equally wish you well but wouldn’t want to be in your shoes.

I sold all my shares the Friday before the flight. Buy on rumour, sell on news!

This will be profitable in the future. The Internet was a wild idea once too.

First mover advantage, but has taken many years to fly into ‘space’ successfully (17 years) and during that time no one else has come close to doing similar. For space tourism a space plane seems like a better solution than a rocket, from the perspective of comfort, regardless if you have to wait 10 minutes at the end for a tow back to the terminal. No customer will really care about the tow, or how it is operated.

They need to ideally reach the karmen line though.

There is still the supersonic travel market to come too which is arguably more lucrative.

I only got 1.2 but see this as long term.

If you could have brought shares in ‘the internet’ you’d have done fine but you can’t you had to buy shares in AOL, Netscape, Boo, Worldcom, The Globe …

@piggeh please don’t think of this as an assignation job on your post. I genuinely want to talk about this stuff and I’m not expert but …

Other than Blue Origin, ULA, Space X, Rocket Lab, Arianespace & Northrop Grumman plus more I’m probably forgetting. All of these companies (other than BO) have focused on the profitable bit of the space economy and hat is hauling satellite into orbit & people to the ISS.

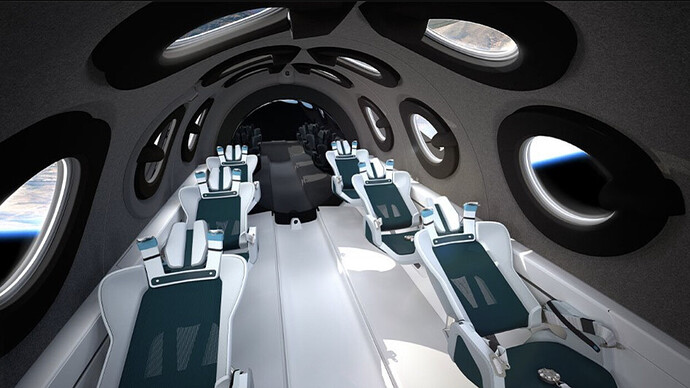

When you dream of space travel and spend a huge amount of money on a once in a life time trip every detail it absolutely matters. A rocket is simply so much cooler than a rocket glider. The windows on VG are tiny aeroplane style windows, BO have got a massive viewing window on the New Shepard. What’s the point in going if you’re not going to see much?

This is the carrot they’ll dangle to keep the hopium going for the bag holders. They’ve spend 17 years to get the this far and RB brought a space going craft that had successfully completed test flights. What makes anyone think they can now take a 4 person cable controlled rocket glider and turn it into a supersonic jet? To do this would be like climbing Ben Nevis and then thinking it’s only a bit of rock I’ll give Everest a go next.

Windows just have to be big enough. The windows on the space plane are big enough and bigger than a standard window on an airplane.

Many of the years since RB invested into scaled composites space plane have been spent redesigning the plane and in developing a new thruster engine that can go at supersonic speeds to get the plane into space. They already have deals in place within the supersonic flight industry to expand into that market.

Fundamentally Virgin Galactic will be revenue generating within the next 6-12 months and will then be in a position where they have the technology to expand into new markets, and a significant moat for space tourism using a plane rather than relying on a rocket.

Lastly, Jeff Bezos and Richard Branson both believe space tourism is profitable. I’m quite willing to believe that both are correct and that space tourism will be a significant profitable industry in the future.

For $250,000 people are very demanding and when your competition have something better everyone will know about it. After all the whole reason to nearly go into space is to see out of the windows.

They lost $189m in 2020, ignoring the obvious additional costs associated with the flights (fuel, maintenance, crew, tow rope for the Land Rover) they would need to have 756 paying customers & fly 189 a year to reach break even. They have 600 reservations currently.

Since the SPAC reverse merger Chairman Chamath sold his entire personal stake ($250m) & Richard Branson has sold over $150m worth of the stock. When insiders who know everything about this business sell you should too - they’re telling you they don’t think this is a long term investment / massively over valued.

Once someone else releases a vehicle that has windows 1 inch bigger than Blue Origin then will Blue Origin be insufficient? It’s not a case of ‘biggest window wins’. Going above the Karman line is a bigger issue for Virgin Galactic to overcome as some will not buy seats whilst it flies below it.

Since the SPAC reverse merger Chairman Chamath sold his entire personal stake ($250m) & Richard Branson has sold over $150m worth of the stock.

Mr Chamath was not a long term investor in VG and Richard Branson was raising funds to fund the Virgin Group through Covid. Neither of these are a sell signal to me personally (especially Chamath). If VG are unable to sell the $500m of stock they are going to issue, then that will be more concerning.

I think where you and me differ is that you see this as a high risk/no reward stock vs me seeing it as a high risk/high reward stock. I am willing to hold a sizeable amount and see where it goes, because the upside can be tremendous.

You haven’t addressed the serious whole in financials and business model I raised above. How they’ll ever make money is beyond me and I want a company I invest in to be able to do that otherwise it won’t be a company for long.

BO can go for as long as they like not making money because Jeff Bezos is good for $1bn a year in funding and now has more time on his hands.

You’re probably right here. If they had some IP or a business plan other than maybe we’ll make a supersonic jet (technology that was proven unsustainable with government support) I’d be more into this stock. It makes a mockery of the new space race and will bring down plenty of good profitable companies when all this goes bang in the next 12/24 months.

You haven’t addressed the serious whole in financials and business model I raised above. How they’ll ever make money is beyond me and I want a company I invest in to be able to do that otherwise it won’t be a company for long.

It’s covered in their initial SPAC merger presentation:

https://www.sec.gov/Archives/edgar/data/1706946/000114420419034053/tv524921_ex99-2.htm

They will reach the number of passengers required unless they run out of cash (they paused taking reservations several years ago but had a lot of queries - 600 is not a true indicator of demand). The $500m is required to give them more of a ‘runway’ to profitability. Could they run out of cash? Yes. I think that is one of the biggest risks because they have not executed to original timeframes. But if they get to flying frequently then they will be profitable before considering latter phases of their business plan (decreasing ticket prices, supersonic travel etc) that will increase it further.

I’ve read the S1 before and have my issues with it and the assumptions made but … I don’t think it offers much to the debate if we both keep going back and forth taking over the thread. I’ve genuinely enjoyed discussing this one with you and I guess old master time will be the final judge.

Well said ![]() but as an interesting prediction what do you both @NeilB and @piggeh predict the SP will be on say the 1st January? Only fair i guess as well and say $50.

but as an interesting prediction what do you both @NeilB and @piggeh predict the SP will be on say the 1st January? Only fair i guess as well and say $50.

That’s a good challenge ![]() My qualifier is that no one can go a few cents higher or lower or we get into one of those ‘price is right’ debacles where someone predicts 1 cent higher or lower

My qualifier is that no one can go a few cents higher or lower or we get into one of those ‘price is right’ debacles where someone predicts 1 cent higher or lower ![]()

Firstly they will recover the short term sell off from this dilution. I think (hope) they start commercial flights towards the end of the year so I’m going to say $55 (I do think a little lower but I will leave a margin from your guess).

By 2025 it will be either $0 or $800. When it is $800 maybe I will pay for @NeilB to take a trip so he can check the windows are big enough ![]()

So it’s time for ![]()

![]() the @Big-g SPCE share challenge

the @Big-g SPCE share challenge ![]()

@piggeh come on down!

@NeilB come on down!

January 1st 2022 - $25.86

January 1st 2025 - $8.60

(Assuming there are not more dilutions other than the 4% they’ve announced)

If I win I’ll but @piggeh a bottle of virgin cola and box of ice lollies shaped like a proper rocket! ![]()

![]()

One thing no one has pointed out is the age and health of the people who can actually afford these flights.

You don’t have to be super fit to travel in the VG plane, with it’s lower G force needed to get to space, than the ones using rocket technology. The VG system is a much better one for the middle aged plus rich people.

For me personally, If I could afford a ticket, I’d prefer to do it with Virgin and the smooth plane ride up and down, than sitting on top of a rocket and relying on parachutes to get safely back on earth.

But Tuesday’s Blue Origin launch will carry the oldest person to ever go to space? She’s 82 years old.

And a straight up gold plated boss!