Jesus. The Mail tomorrow.

I had a Corporate bond ETF that I was holding for the last couple of months. It was giving me a decent yield paid monthly. But the other day I decided to sell my position with a decent gain to unlock some cash for purchases.

In my opinion there are going to be a lot of companies struggling big time and a lot of them going in bankruptcy. Majority of the companies are indebted to the absolute maximum.

We couldn’t have a worse moment for that virus to hit. After such a bull run and generally good times the confidence was at all-time highs. People couldn’t believe anything bad could happen, neither did companies, neither did governments. All of them are indebted to no return. We are in for a wild ride in my opinion.

Presents short term complications if you are an income investor. A market rebound won’t come in a spike, but more of a gentle curve over the next 2+ year (dependant on us actually dealing with it!). Taking the opportunity to personally invest in a UK all share tracker fund due to the potential liquidity risk of individual companies and current low valuations

They are in Australia.

NBA suspending all games after today (“yesterday”) until further notice ![]()

Uber asked all employees to work from home.

What a massive overreaction.

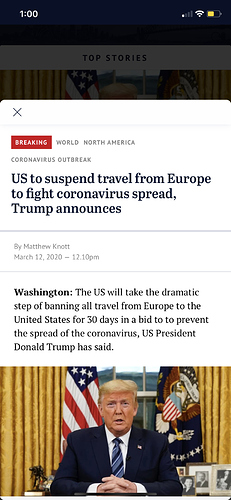

I was expecting, given how Trump has been underplaying corona, that the US were just going to allow the virus to spread and largely keep the economy flowing.

I’m expecting the market bloodbath to continue. People were expecting some stimulus measures, not global isolation.

Here we go again… A gentle slip further down maybe

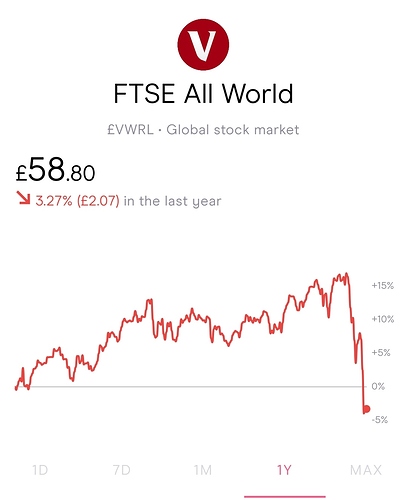

FTSE down nearly 5% from the off. Hold tight.

What needs to be asked is what’s the hidden agenda here?

I seen a stat that on the peak day for deaths (which is terrible I’m not downplaying that) but more people died from being bitten by snakes on that same day.

Are they going to use this to get rid of cash? Roll out their carbon travel taxes? the biggest work from home experiment taking place…

Be interesting to see what comes of it, yes I’m cynical like that but you’ve got to be.

The markets simply don’t know how to account for the impact of the virus. The default reaction is to sell assets seen as higher risk, move to lower risk and wait for a sign that the equities risk profile is more appealing.

Cheaper retirement tokens!

The question is, will the market be pricing in the high quality companies with the damage already included pre Q3, or, will prices look good soon and when Q3 losses are revealed we see another 5-10% drop later in the year.

Looks like there is no end to this.

Surely, this isn’t only caused by the travel ban but also by the fact that many companies, especially in the US have excessive levels of debt, and are going to have real issues refinancing…