From an Irish publication. Better delete the browser history so ![]()

On a serious note if anyone has any small things I can do/advice for an extra layer of added security that would be great

Repost—for anyone who’s used their Wifi:

Thanks Engineer unfortunately I don’t have a choice in that matter of working in WeWork or not

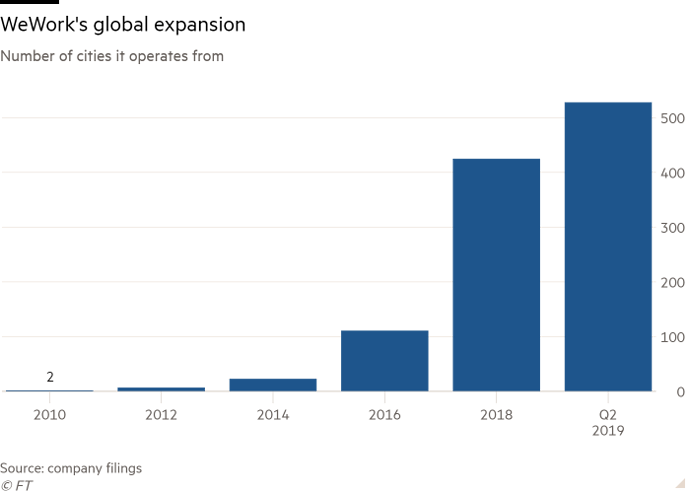

WeWork Global Summit cancelled.

Also, Meetup—acquired in 2018—may be up for sale.

Executives didn’t offer a solution for workers whose shares may be underwater based on recent valuation estimates from WeWork’s financial advisers

…

Privately, executives have explored a sale of several recent acquisitions, including Conductor, Managed by Q and Meetup, as well as a private jet and a large stake in the Wing, the female-focused co-working startup

Source - WeWork to Cut 2,000 Jobs After Pulling IPO - Bloomberg

@shane-aurora doh!

Two landlords of large WeWork sites in London, who asked not to be named, said they would not sign new leases for the foreseeable future and were making contingency plans for their existing WeWork offices in the event of a restructuring.

…

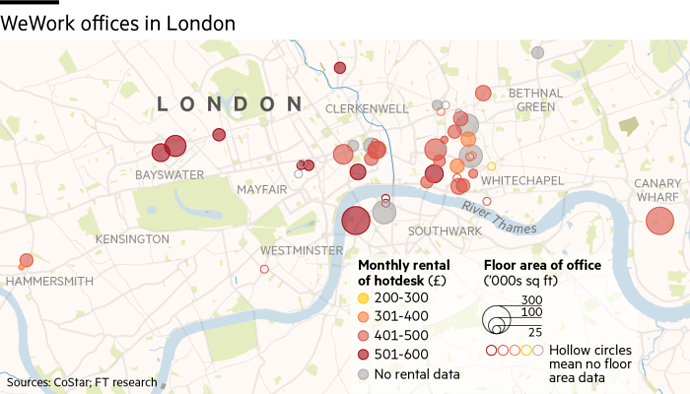

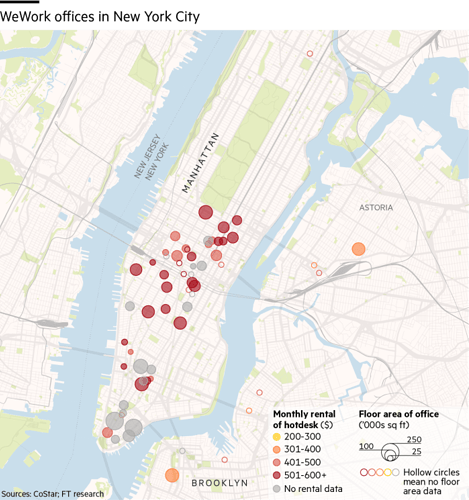

The real estate industry has in recent years embraced WeWork and its rivals. WeWork has 7.7m sq ft of office space in New York City and 4.1m in London, according to data provider CoStar, making it the largest private tenant in both cities. Other key locations include San Francisco, Bangalore and Shanghai.…

Much is now at stake for its landlords. They have a total of $47bn in rent due from WeWork across the life of its leases, according to the company’s filings. Some $2.3bn of lease and other cash obligations fall due in 2020, according to academics at Harvard Business School.

Two London building sales with WeWork as a tenant have collapsed since its IPO was pulled, although people close to one — the £850m sale of Southbank Place — maintained the group’s problems were not the reason.

In the event of a restructuring that involved WeWork ditching some of its sites, landlords would bring in other flexible office providers to fill vacancies or install their own brands, said agents and landlords.

WeLondon:

WeNYC:

WeGrow:

Source for more - The end of the WeWork boom rattles property markets

The house is coming down. I didn’t think WeWork were Enron/Theranos bad a few months ago but looking like they could be joining the club

That was one of the first things I ever watched on Netflix. Great documentary and almost unbelievable at times! Some of the things in it at crazy to say the least.

So what does one of We’s major banks and a no-IPO advisor do?

Goldman Sachs has set up a disaster recovery trading floor in a WeWork office in central London to enable the bank to continue operating in the event of a major disruption.

Source - Goldman Sachs sets up emergency trading floor in WeWork office

This is huge because it’s a long-term commitment. Or maybe that’s one way to save one of your clients—by injecting some money into it.

Classifying debt as “Non-performing loans” is not an option at GS ![]()

WeWork is burning cash fast rent and debt servicing and has maybe 2 quarters left before they run out of money (an estimate given by Prof. Galloway in one podcast recently).

Not sure if you’ve posted this on the site @engineer I know you’re a big fan of Prof. Galloway. A friend of mine sent me on this, this morning.

Galloway is always very entertaining. Agree with him on many things but not sure about his take on Robinhood/Schwab in that piece.

Their engineers are up for grabs. 500 to go. That may leave 300-500 left to support that “tech” real estate play.

From an S-1 analysis earlier this year:

Source - Report: WeWork expected to cut 500 tech roles | TechCrunch

Now that Morgan Stanley is out of the picture—because it lost the losing race to run WeWork’s IPO, having valued We at $ 40-100 billion—they can issue all sorts of research and laugh about it like it never happened:

“Morgan Stanley estimated that Goldman Sachs owns a 1.4% stake in WeWork, and that JPMorgan, which was slated to be WeWork’s lead underwriter, owns a 4% stake.”

“Morgan Stanley analysts said in a recent note they are now ‘baking in’ Goldman Sachs taking a $264 million writedown on its WeWork investment in its third-quarter earnings.”

…

“That outlook comes after the financial services firm Jefferies told investors back in September that it had to write down $146 million related to its own WeWork investment in the third quarter because of uncertainty about timing and valuation of an IPO. That writedown was as of August 31 — more than two weeks before WeWork shelved the offering entirely.”

Source - Jefferies Slashed Value of WeWork Stake by $146 Million Before IPO (Google the article if you can’t view it)

The Jefferies write down is another example of Wall St insiders abandoning the ship before the public has a chance—but not this time.

Remember this:

We💌Debt

- Cash-strapped WeWork pulled more than $60 million from its UK subsidiary and lumped it with close to $240 million in extra debt in 2018.

- WeWork International Limited grew revenue by 90% last year, but payments to its parent company for intellectual property and other support services fueled a tenfold surge in pre-tax losses to £76 million.

- The UK company’s wage and salary costs soared 150%, and its interest payments jumped sixfold due to the increased debt.

Source - WeWork UK Paid $60 Million to Parent, Tripled Debt in 2018

JPMorgan to the rescue

Correction—WeWork is likely to have no money before Christmas, apparently:

Two people briefed on the fundraising efforts said the office company’s cash crunch was so acute that it had to raise new financing no later than the end of November. Fitch Ratings downgraded WeWork’s credit rating last week to CCC+, warning that the lossmaking company’s liquidity position was “precarious”.

JPMorgan Chase, the Wall Street bank that had led the office company’s IPO preparations, is leading the financing negotiations and considering a contribution to the new package, several people familiar with the matter said.

Haha ![]() (14 August)

(14 August)

Well, that escalated quickly

also this:

Editor’s Note: This episode of the Business of HYPE was recorded earlier this season, prior to the developing news on the company. The information shared within the episode has been unedited since its recording and is being released as is.

We owned Meetup. Yikes.

Safe to say that’s the death of Meetup. Adam Nuemann is the opposite of King Midas everything he touches turns to shit

![FYRE: The Greatest Party That Never Happened | Official Trailer [HD] | Netflix](https://us1.discourse-cdn.com/flex019/uploads/freetrade/original/3X/0/3/036d6ddc350eed4a349e86ec81d40402c8723dcb.jpeg)